“No one told you when to run, you missed the starting gun”

Pink Floyd, Time

Understanding Time-Based Customer Behaviour Models

In our previous discussions about predictive modelling for customer retention, we explored models that predict a customer’s propensity to transact within the next N days, where the clock starts ticking from the day you score the model. However, there’s a crucial use case where timing begins from the customer’s last transaction date.

This approach addresses two fundamental customer lifecycle management questions:

- First-to-Repeat (FTR) Modelling: What’s the probability that a first-time customer will make a second purchase within 90 days of their initial transaction?

- Churn Prediction: What’s the likelihood that a customer will become inactive (churn)?

In retail environments, customer churn doesn’t involve explicit actions like filling out cancellation forms. Instead, it’s defined by inactivity—no transactions for a specified period since the previous purchase.

Modelling Approaches for Customer Retention

Traditional Methods vs. Machine Learning

When building predictive models for customer behaviour, you have two primary approaches:

1. Cox Proportional Hazard Model

- Models time-to-event as the target variable

- Highly interpretable

- Explicitly addresses the time-to-event problem

- Requires extensive modelling of nonlinear interactions for optimal accuracy

2. Binary Classification with Machine Learning

- Treats the problem as predicting propensity to transact in N days

- Gradient boosting algorithms typically outperform traditional methods

- Better predictive accuracy

- Integrates seamlessly with existing ML infrastructure

At SOLUS, we leverage gradient boosting for predictive modelling because it delivers superior accuracy while utilizing our existing machine learning framework.

The Recursive Modelling Solution

The Challenge

The complexity arises because customers are at different stages in their lifecycle when you score them. The remaining time for a customer to transact (for repeat modelling) or remain inactive (for churn modelling) varies based on their last transaction date.

A Practical Approach: Recursive Probability Calculation

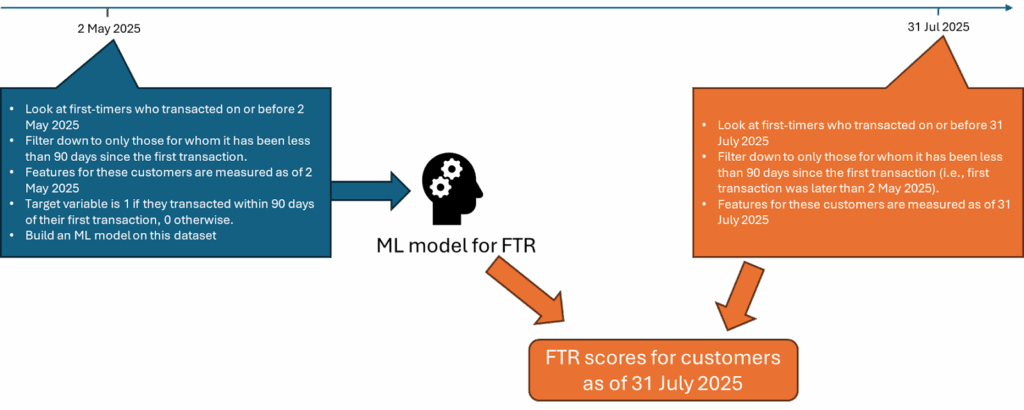

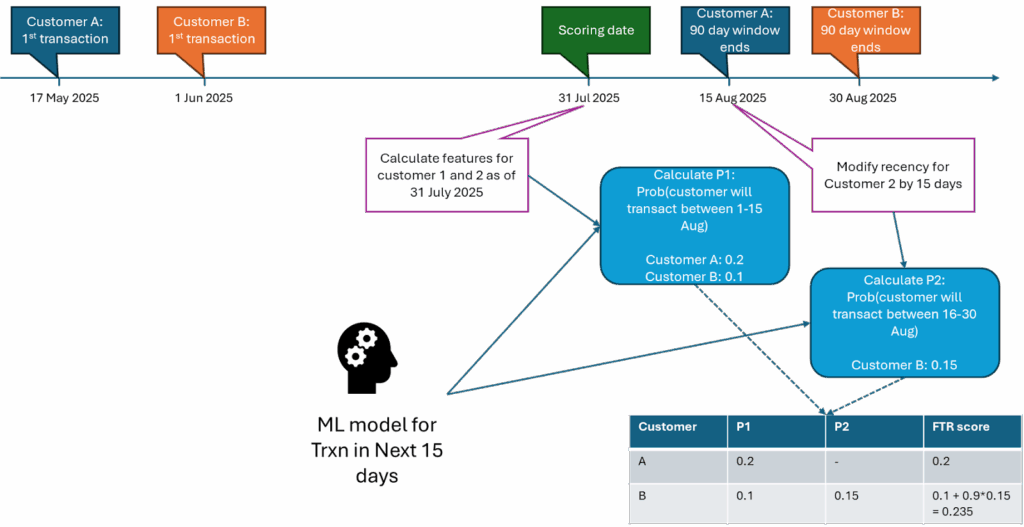

Let’s examine the First-to-Repeat (FTR) model with a 90-day window:

Step 1: Leverage Existing Short-Term Models If you have a 15-day propensity model, you can build upon it recursively.

Step 2: Calculate Probabilities by Customer Recency

- Customer who transacted 75 days ago: Use the 15-day model directly

- Customer who transacted 60 days ago: Apply the recursive formula

The Recursive Formula:

FTR Probability = P1 + [(1-P1) × P2]

Where:

- P1 = Probability of transaction in next 15 days

- P2 = Probability of transaction in the following 15 days (if no transaction in first 15 days)

Implementation Benefits

Advantages:

- Utilizes existing customer propensity models

- Maintains current data (trained on recent 15-day history)

- Applicable to both churn and repeat modelling

- Cost-effective model reuse

Considerations:

- Requires rounding recency to 15-day intervals

- Some bias propagation between model iterations

- Computational complexity increases with longer prediction windows

Applying This to Churn Prediction Models

The same recursive approach applies to customer churn modelling. Instead of predicting repeat purchases, you’re modelling the probability of continued inactivity over extended periods.

The mathematical framework remains consistent:

- Start with short-term churn probabilities

- Apply recursive calculations for longer prediction windows

- Account for varying customer recency periods

Best Practices for Customer Retention Modelling

1. Data Preparation

- Ensure clean transaction history

- Account for seasonal patterns

- Handle outliers in customer behaviour

2. Model Validation

- Use time-based validation splits

- Test across different customer segments

- Monitor model performance over time

3. Business Integration

- Align prediction windows with business cycles

- Consider operational constraints

- Enable real-time scoring capabilities

Conclusion: Advancing Customer Lifecycle Management

This recursive modelling approach bridges the gap between theoretical accuracy and practical implementation in customer retention strategies. By leveraging existing short-term models and applying mathematical recursion, businesses can build sophisticated churn prediction and repeat purchase models without starting from scratch.

The key insight is recognizing that customer timing varies, and your models should accommodate these differences while maintaining predictive accuracy and operational efficiency.

Ready to implement advanced customer retention models? Learn how SOLUS AI’s machine learning platform can help you build sophisticated predictive models for customer lifecycle management.